In September 2019 I was hired as a senior member of Oportun’s brand new Design Strategy team. I’ve worked across lending, credit card, mobile app, marketing, collections, and savings teams, always working to achieve an experience that supports the user while considering business objectives.

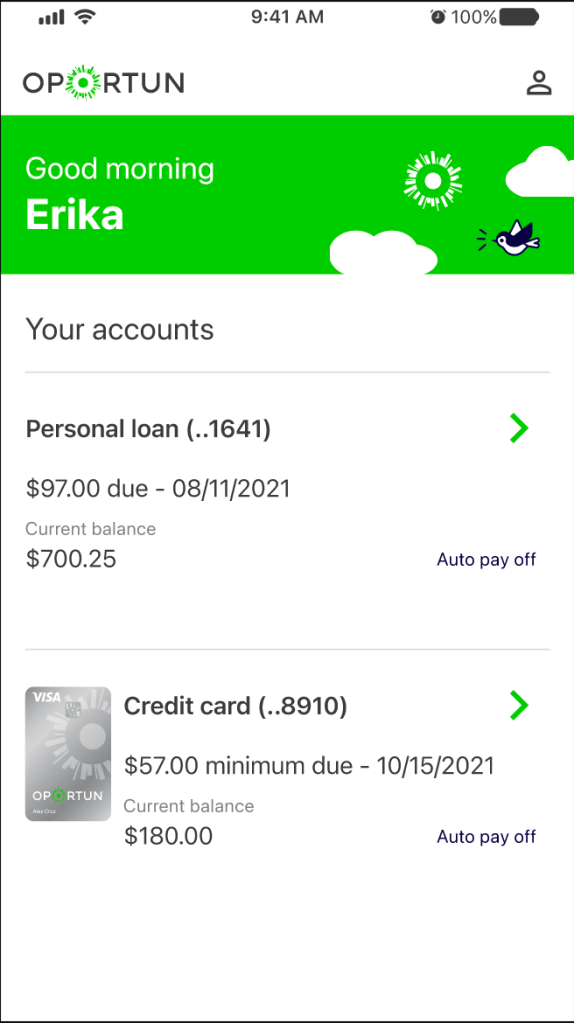

Oportun mobile application

Oportun began developing its native mobile app in summer 2021, launched the beta in January 2022, and closed the beta in March 2023. As the lead, I was responsible for the complete research portfolio, including:

- Developing a research roadmap and outlining use cases and journey maps

- Partnering with product and product design to develop, evaluate, and finalize designs and content

- Unmoderated testing of designs

- Reviews of quantitative data

- Phone interviews with beta customers

- Colleagues volunteered to interview Spanish speaking customers. We reviewed our results as a team.

Outcomes

This was an effort across many teams in a short time and we’re proud of our results.

- ~4700 unique users

- Metrics show we reached a group that represented our customer base. Users were almost 50/50 iOS/Android, and 60/40 English speakers/Spanish speakers.

- ~26000 payment transactions processed

- 81% of users made at least one payment

- 65% of users made multiple payments through the app

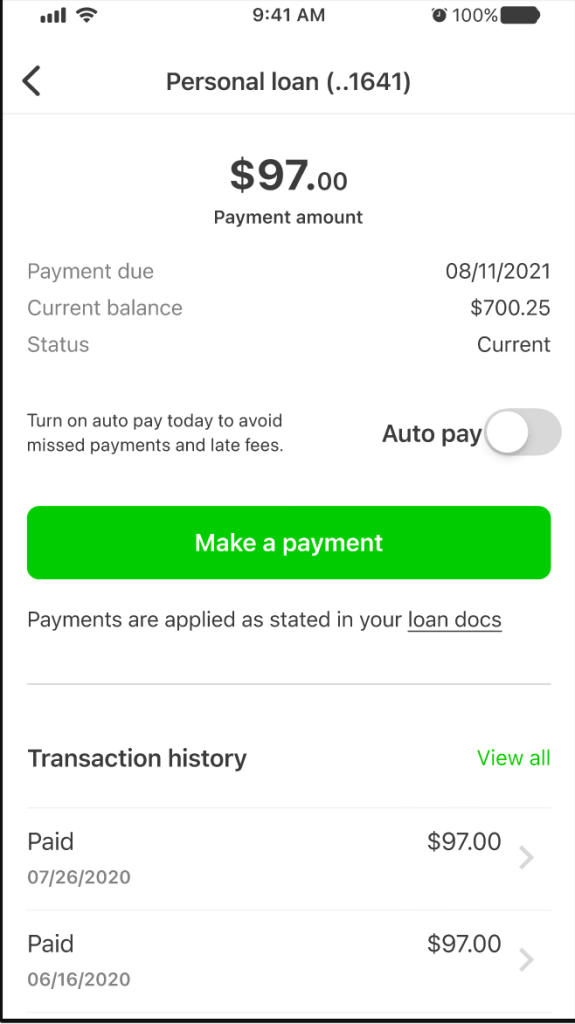

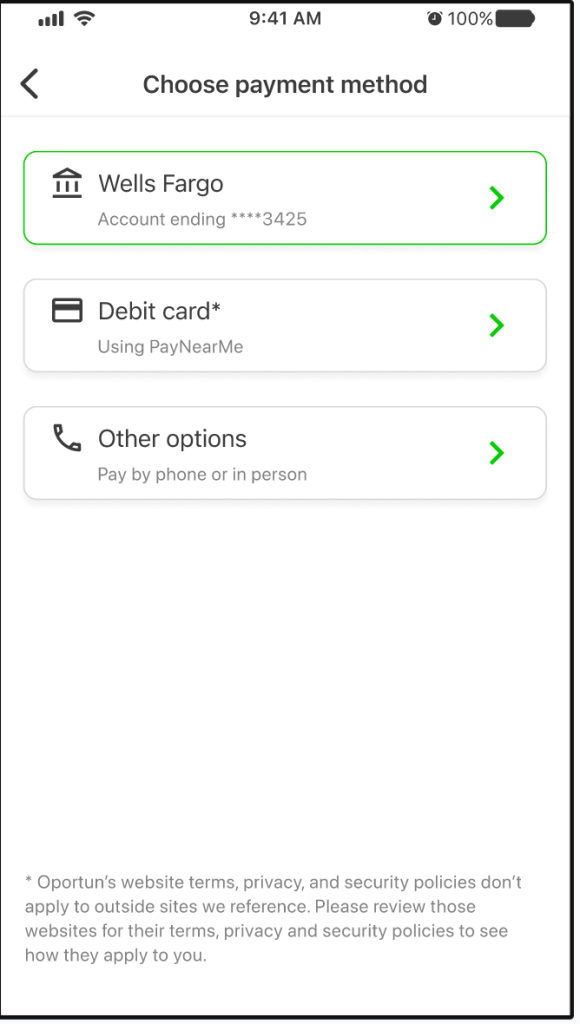

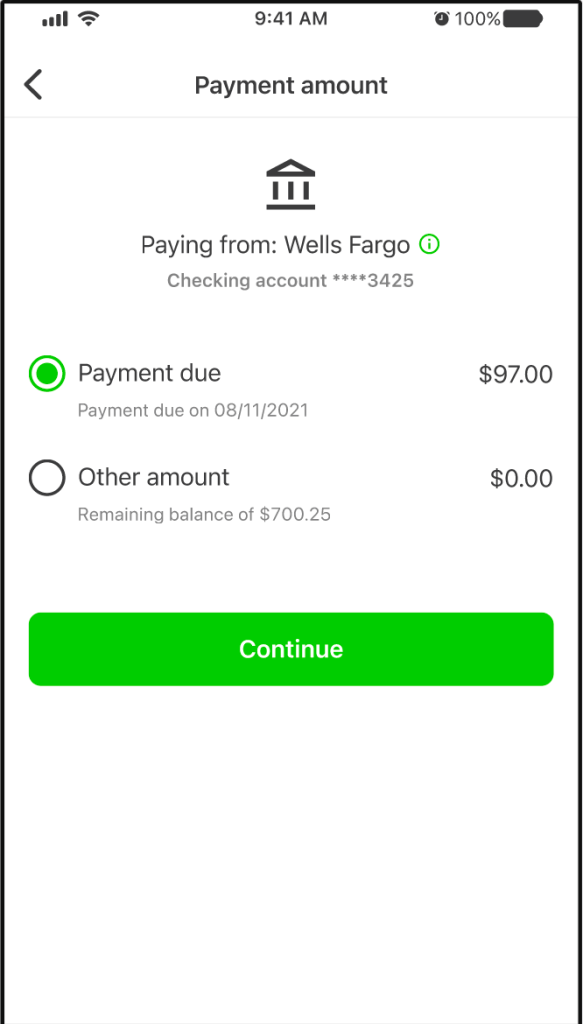

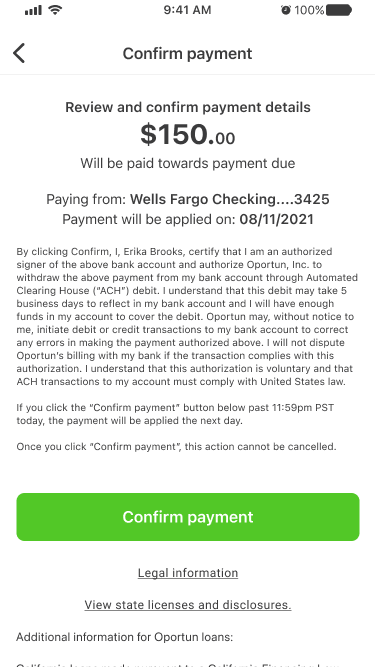

Below, making a standard loan payment in the beta app.

Beta app case study: Onboarding experience

In March 2022, we evaluated our onboarding experience against four competitors.

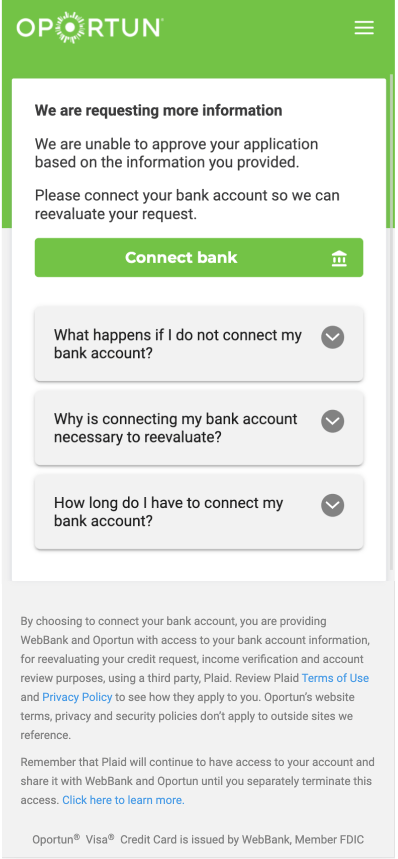

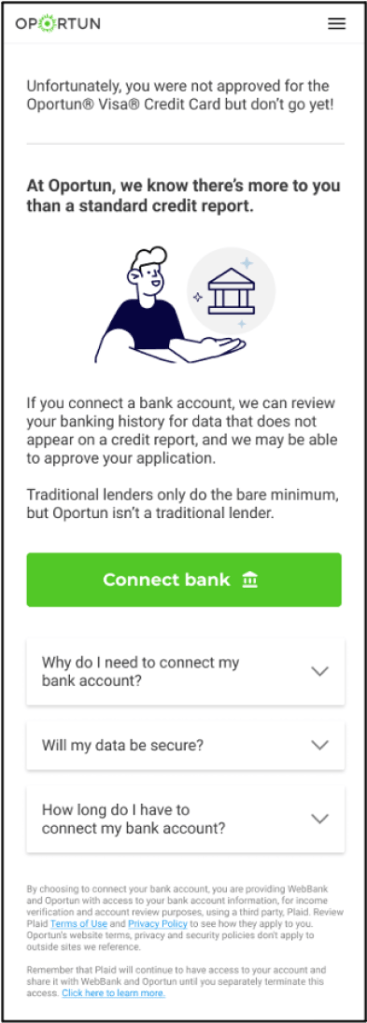

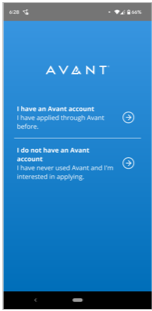

Above, 4 competitors left to right: Avant, Bank of America, Discover, and Capital One. These images are the first screen of each mobile app.

Each competitor faces a similar challenge: onboarding a customer with an existing account, or anticipating a customer who wants to apply for a product via the mobile app. Customers must create an account before applying. Our tests found that our onboarding experience needed a small copy update, but otherwise allowed participants to complete several tasks with the greatest degree of accuracy, no matter their situation.

Online loan application

After several rounds of research in 2021, we implemented a completely new design system in January 2022 – the first update to the online loan application in more than 5 years.

I evaluated the existing site first with our first ever user test on the online loan application, then as a team we use those learnings to develop our proposed designs. We ran moderated and unmoderated user tests on large sections of the prototypes as well as small feature-focused tests.

Outcomes

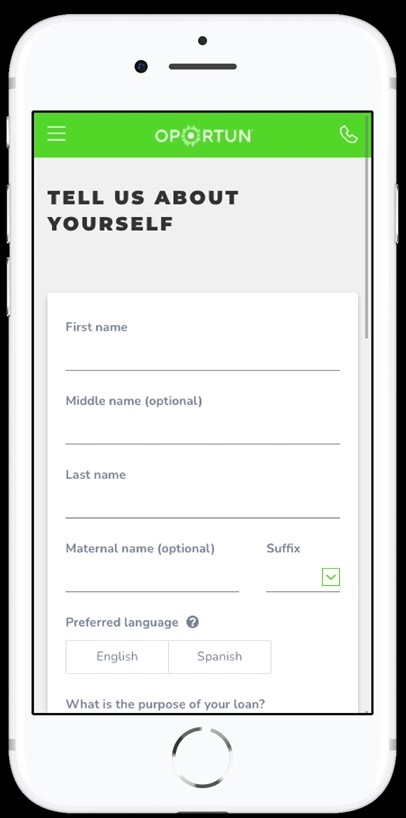

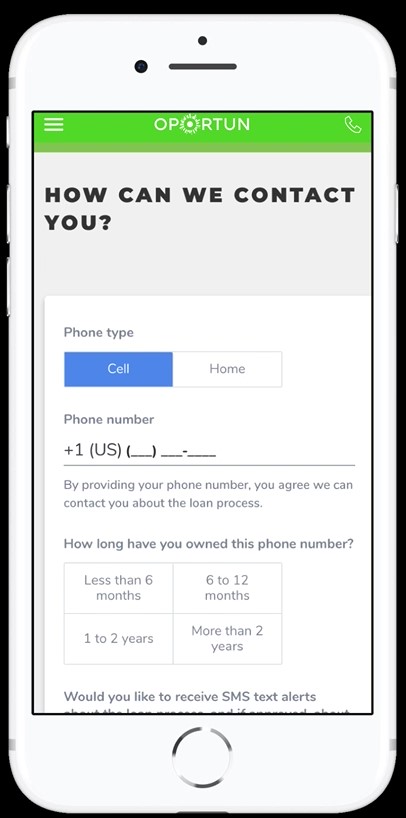

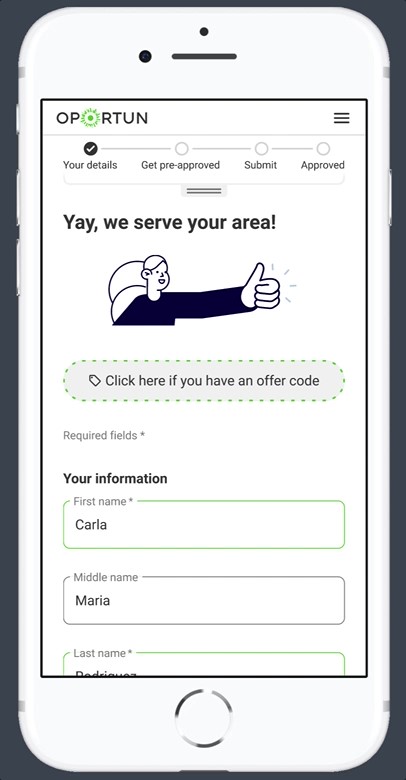

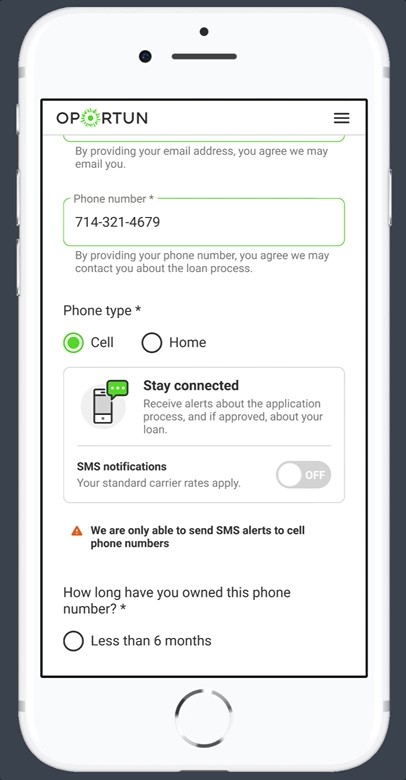

Below are images from both the original and new designs on an iPhone 8. The original designs are left of center (green header); the updated versions are right of center.

Key elements of the design update are:

- Rounded input boxes which are highlighted on focus

- Radio buttons instead of boxes (see the bottom row of images)

- Critical help text that appears when it’s most needed. Excessive text has been removed and critical information is no longer hidden.

- User-friendly language

- We found participants were confused by industry jargon like ‘pre-qualified’ and ‘pre-approved’, and we chose to downplay these messages.

Oportun Credit card

I frequently work with our credit card team on ‘quick hit’ style testing and research. On very short deadlines (typically two weeks or less), we identified an area of interest and gathered feedback via unmoderated testing.

Outcomes

Our testing has led to two major updates, both in production today.

- Implementing a 3-page online credit card application instead of a 1-page version

- Updates to content and illustrations on a credit card offer that improved conversion (‘before’ and ‘after’ shown below)

Collections and loan servicing

I led Oportun’s first effort to get agent feedback on collections systems. This was a 6 month effort requiring:

- Interviews across 8 different teams (3 departments)

- Reviews of 30+ customer call recordings and 2500+ scorecards on agents’ performance

- Reviewed 30+ use cases in system test environment

- Agent survey (40+ responses)

- Reviewed NPS verbatims from customers for a 12-month period

- SMS transcripts between customers and agents

- Review of agent training materials and procedural handbooks

- Created a service blueprints representing the Collections’ agents’ day-to-day

- Created a journey map representing the customer’s journey between retail, collections, and self-service options

TL;DR:

We can significantly improve our internal system. Changes would reduce agent error, which makes their day (and the customer’s day) better and reduces exposure to regulatory fines.

And the longer version:

It’s clear that agents do their absolute best to make our internal systems work. However, development and design mistakes have compounded to create an inefficient system that requires extensive manual effort, hides critical information, and lacks key error checks. Our design flaws land on both retail and phone agents, who have to cover for us with our customers, who can’t always get everything they need in self-service channels, which has poor results for everyone.